Substack says you will need 16 minutes to read this.

This one´s weird and maybe even horrible! I´m writing this up primarily to gather thoughts and - more importantly - feedback and input. While I am long the stock (Disclaimer and stuff!), my conviction is on the lower end. BUT I think it is an extremely interesting situation from an intellectual point of view and there will for sure be learnings from this one! If that is not enough for you, I tried to put lots of pictures in here!

The market cap of Clearside is very low and its liquidity even lower. Do not buy this bceause an unemployed, bored dude on the internet writes bullish stuff.

Clearside Biomedical (CLSD) recently initiated “strategic alternatives” (PR) and fired all(!) personnel. I have reason to believe we´ll see one or more transactions this year.

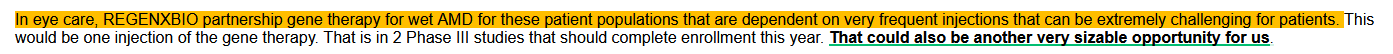

They own a Phase-3-ready product (with decent to heavy competition), no net cash and a whole series of milestones and royalty rights connected to its “micro-injector technology in ophthalmology”. Especially two of those are interesting, as they relate to an approved therapy marketed by Bausch (XIPERE) and a therapy ABBV is (co-)developing. They´re calling it a sizeable opportunity and that implies a value worth many multiples of Clearside´s market cap.

BUT this is where it starts to get hairy: Clearside actually sold its rights to the first ~106 million US$ of proceeds (from any source basically).

The company also has not enough net cash to survive until “maybe-cash-flow” on its own as of now.

Clearside has no large institutional holder that is known.

Ex-CEO (now advisor) owns a sizeable chunk of shares and options.

There are a couple of warrants outstanding that might become annoying. But that´ll probably only happen in a case where the stock works great.

There are paths to a multibagger as credible as a path to zero!

All calculations referencing a stock price of 3.61 US$ / market cap of 18.9 mln US$.

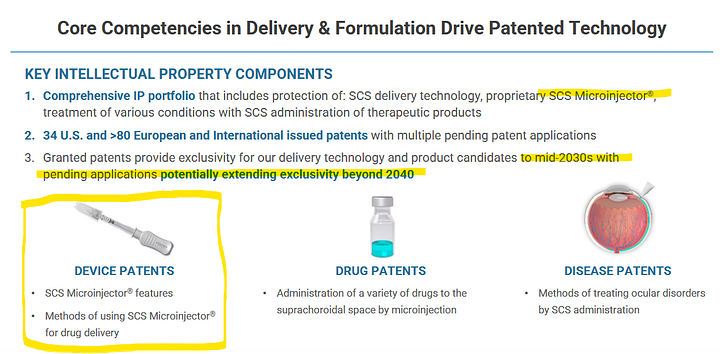

What this is about: The Microinjector

2 elemental slides / pictures framing the technology owned:

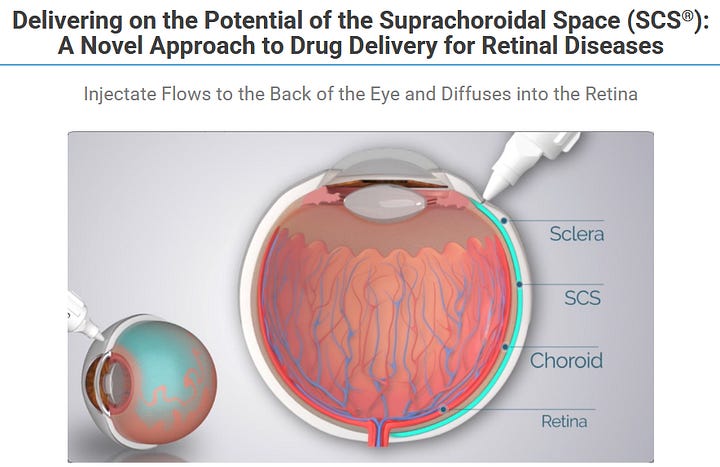

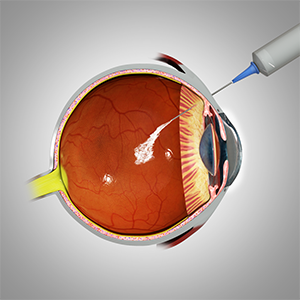

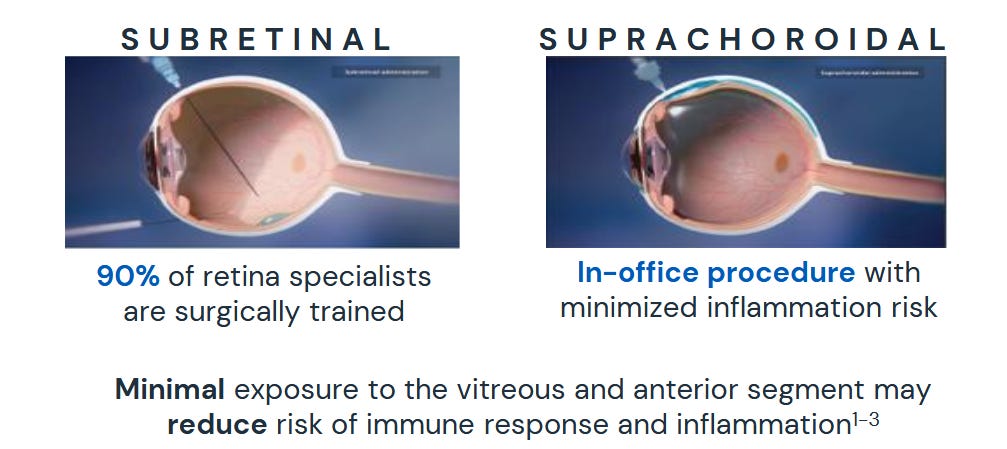

We will circle back to this several times, but the core value proposition of CLSD-technology is, that they can deliver drug into the eye without poking a needle into your eyeball.

Just compare the above picture from CLSD to this “regular” injection procedure. I don´t know about you, but my brain tells me to just run away:

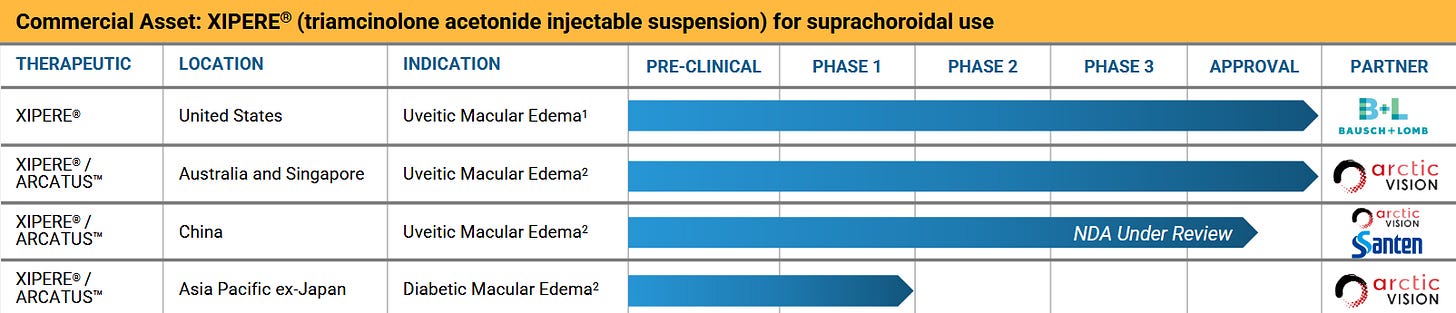

Whenever we will be talking injections to the suprachoroidal space, that´s basically a reference to the CLSD microinjector. Now the good news: This is not science fiction but actually used in a FDA-approved product: XIPERE (Approval PR from 2021).

Recently, Australia and Singapore joined the ranks with China to follow soon (probably). The technology is also licensed to 3 more parties with 2 of those in very advanced development stages:

Before we get all too excited about this, let´s sprinkle in some bad news! But first:

Housekeeping: Market Cap and EV

After the recent 1:15 reverse split, there are 5.23 million shares outstanding. Pro-forma cash (adjusting for some inflows and restructuring) as of June 30 is 9 million US$ with roughly 6.4 million US$ in liabilities (including 70% of long-term lease liabilities). So I think they are roughly broke by about soon, probably safe to assume a couple of million US$ in net debt here until deals are closed.

Speaking of debt, here comes the first major enemy to the bull thesis: In 2021, they received 32.5 mln US$ from HCR in gross proceeds and in return sold their rights to the first royalties and milestones received from the microinjector-technology. There was a minor and cryptic amendment to this just recently, where Clearside received 3 mln US$, actually has to pay back less in total (still a whopping 106.5 mln US$ with 1.5 done so far) but moved some remaining assets under the umbrella of this agreement and cleaned up the agreement for the probably upcoming transactions.

Now we have the 2 major hurdles (don´t worry, there are more!) to overcome: Payments to Clearside have to pay off the remaining 105 million US$ payments to HCR, 3-10 million US$ in net debt and today´s market cap of 19 million US$. Looking at it that way, the Enterprise Value sits at 127-134 million US$. That´s not true for assets outside of this agreement (which could flow to CLSD equity directly), but given the cryptic language in the 8-k linked above, I´m not sure whether there are assets remaining outside of the scope of this agreement.

There are also 740k warrants out with a strike of 24.3 US$, which have to be redeemed at Black Scholes in a change of control. Given the high strike, not a big worry here. They might dampen a win a bit, but my concerns are somewhere else.

I think this is where 90% of the usual “strategic alternatives”-investors just call it a day, but I think there is reason for hope and I will demonstrate, why. But first: more bad news!

The assets and licensing agreements

So far, CLSD has 4 major agreements ongoing where they are poised to receive payments. The bad news is, that they in-licensed the technology partly themselves. They are subject to a “low single digit” (I assume 1%) royalty on sales and a 8% sublicensing-fee on upfronts and milestones. They also have to pay maintenance payments of a couple hundred thousand US$ a year.

Phase-3-ready CLS-AX in wAMD

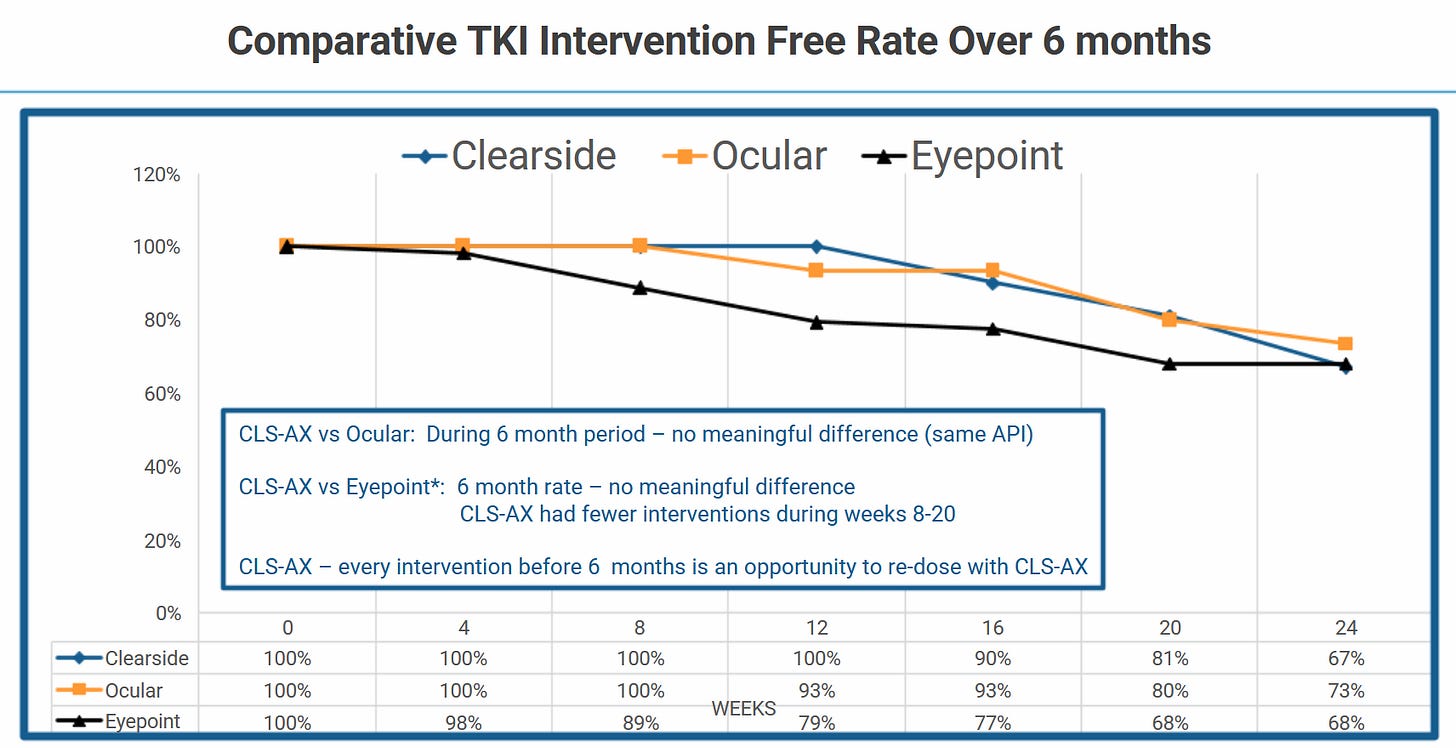

Besides the sublicense-agreements, they own CLS-AX . I do have a lot of questionmarks here. This is from the probably cherry-picked CLSD slides:

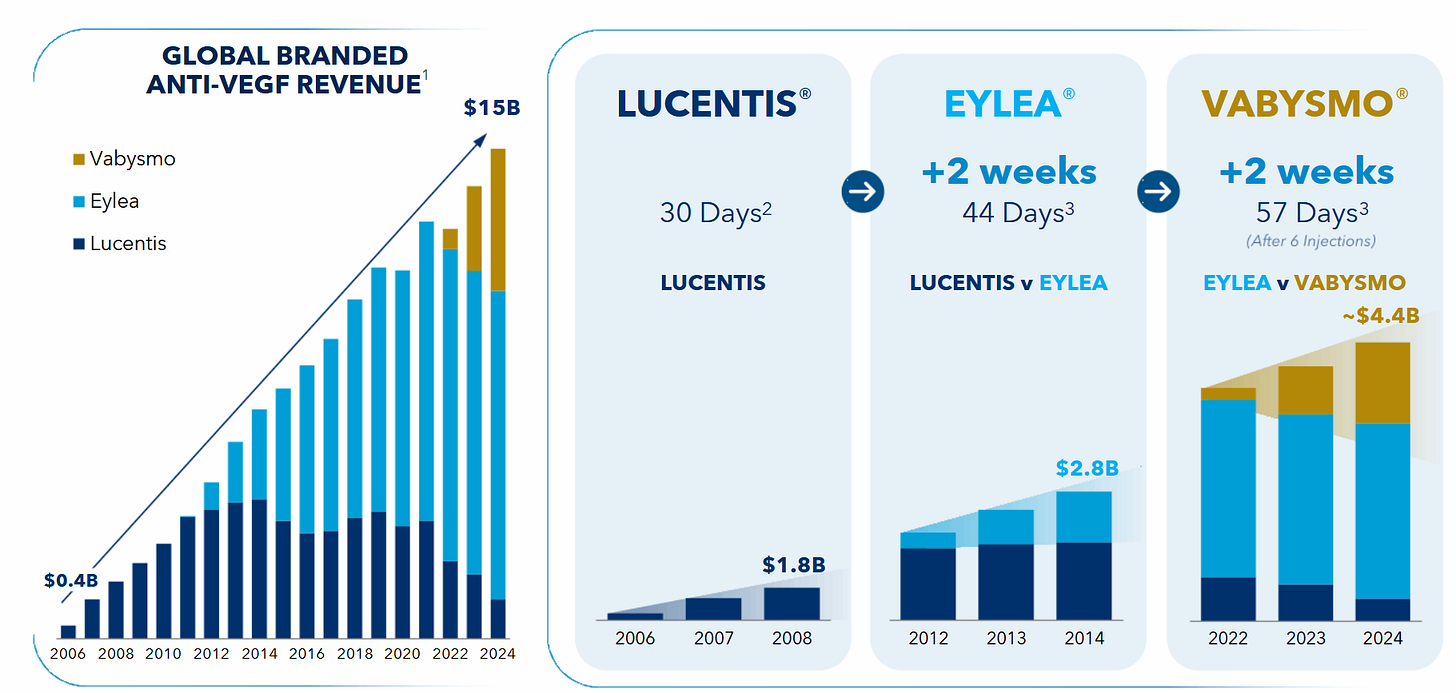

CLSD appears to show similar efficacy. Eyepoint is valued just short of a billion US$ and Ocular is chilling at a valuation of 2.1B US$, with both of them shortly before their respective Phase-3-readout in long-acting therapies (to reduce the amount of times a year you need to stick a needle into your eye!) for wAMD-patients. We´re talking a 15B US$ market here, this slide is from Ocular:

Now I don´t know if Clearside´s therapy is as competitive as they show. But there is clearly demand for “less eye-poking” and Clearside could not only provide less poking in general (vs Eylea/Vabysmo), but suprachoroidal-micro-poking instead of needle-through-your-eyeball-poking. This might sound extremely superficial (because it is) but I also think it makes a bit of sense?

The caveat is … clear: CLSD obviously somehow failed to gather financing or strike an otherwise acceptable partnership agreement or they would not be in the situation they are in. But we also know that the past 12 months have been absolutely horrible for financing anything but the most promising therapies. Compared to the market cap (or even the full EV if CLS-AX is now also subject to the HCR agreement) this can surprise wildly to the upside. But I am actually listing it as simply a wildcard - we have more assets and ground to cover!

Xipere - marketed by Bausch

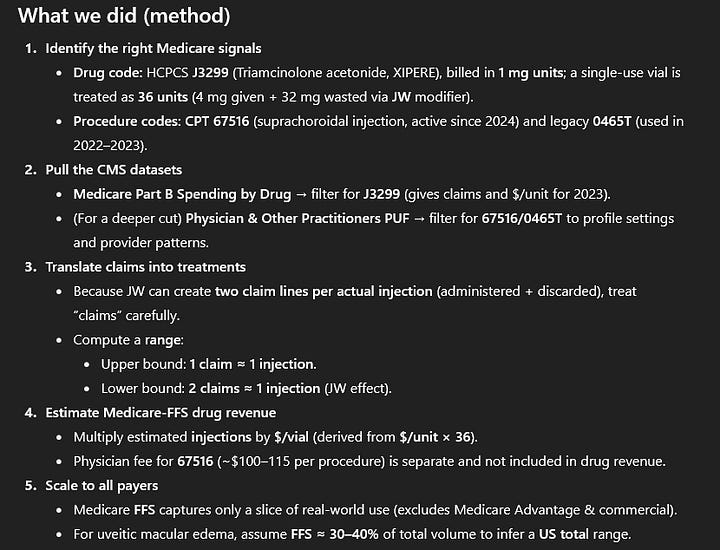

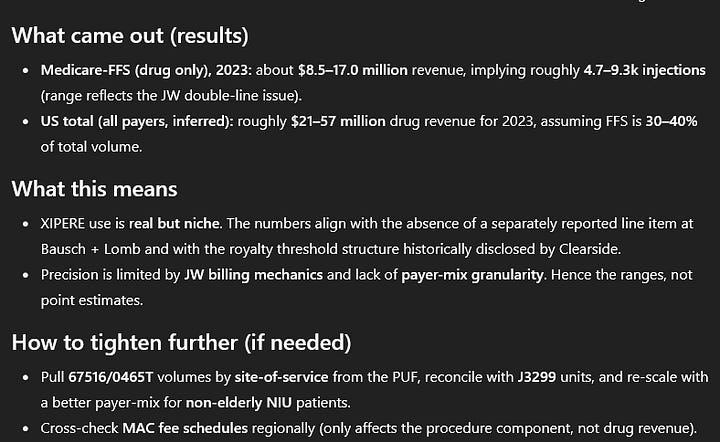

Let´s add more obscureity! As I teased before, Xipere was approved in 2021. As I understand it, it is basically a corticosteroid to treat Uveitic Macular Edema, but injected using the SCS Microinjector. So the underlying drug is not really novel, which is probably one reason for sales that are - so much we do know - for sure no blockbuster. This also is like a 150-300 million US$ market according to ChatGPT, it estimates that Ozurdex from ABBV does about 90-100 mln US$ in Uveitis worldwide.

The main issue for us: Neither Bauch nor Clearside tell us anything about the sales and Bausch is not obligated to pay any royalties on the first 45 mln US$ in sales (in total, not annually). All we know is that sales have been less than those 45 mln US$ so far.

Naturally, I asked ChatGPT to do the work for me and it came up with quite an interesting result:

I would love to hear feedback on that. I think it is very obvious that the estimates are too optimistic. If Xipere had done 21 mln US$+ in 2023, Clearside would probably be booking some royalties already, as the 45 mln US$ hurdle would most likely be cleared.

So maybe there are some additional rebates or methodological weaknesses the AI is overlooking, but the treatment is obviously used? Even if Xipere does only 30-40 million US$ in the long-term, Clearside receives “high teens to 20%” of royalties or probably 15-16% net of the 1% they have to pay.

One interesting nugget is that we will hear RGNX talking positively about Xipere soon, so I guess somewhere between 30-50 mln US$ in sales or 4.5 to 8 mln US$ in annual royalties to CLSD is attainable? I don´t expect Xipere to do the heavy lifting required to pay off the HCR agreement, but I would not be surprised to see some meaningful contributions. And once HCR is paid off, we´re talking 25 to 50% of the current market cap in annual royalties. There are also 55 mln US$ in additional milestones. Wouldn´t expect too much here, maybe a couple million if annual sales of 50 mln US$ are achieved? Ignoring them for now.

They also licensed Xipere to a chinese partner, NDA accepted in February 2025. 22.5 in total milestones remaining with tiered royalties from 10 to 12% of sales just for China.

The crown jewel: REGENXBIO/ABBV-partnership

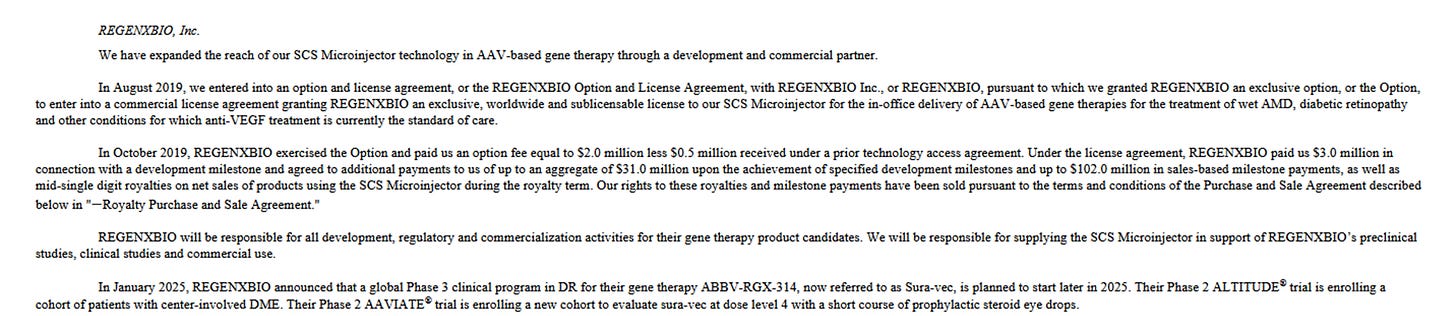

It is kind of telling that we have talked about one approved asset and a Phase-3-ready therapy with peers in the 1-2B US$ range and only now look at what I think is the most compelling opportunity in this mess. I´m putting the summary of the agreement in here:

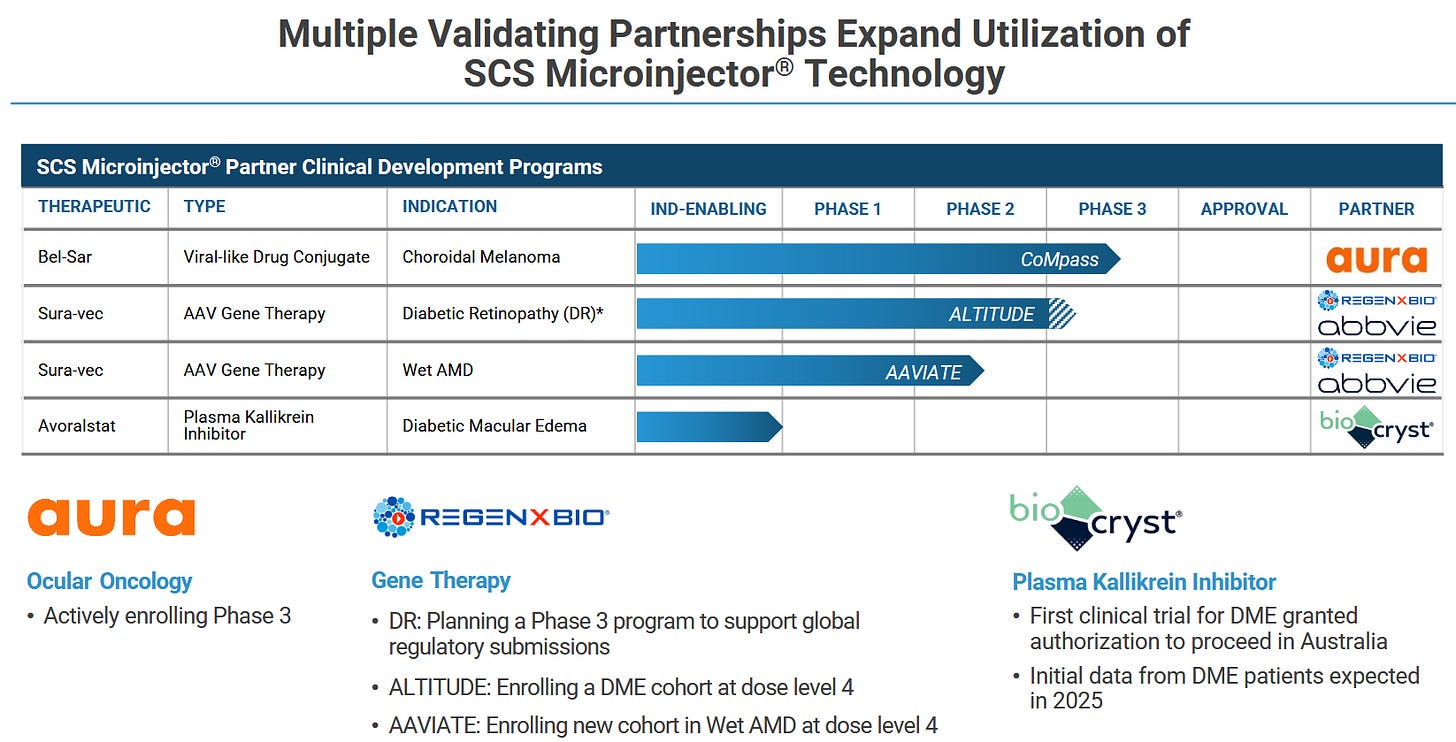

CLSD is basically out-licensing its Microinjector to RGNX for use in ocular gene therapy. If you are curious about the current state of ocular gene therapies, look at a chart of Adverum (ADVM). If you were to assume the current sentiment to be “not great”, you would not be wrong exactly!

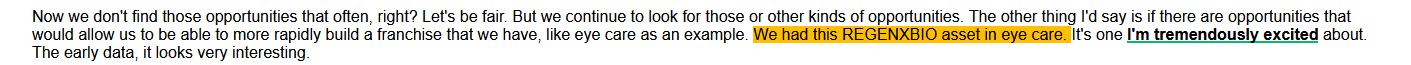

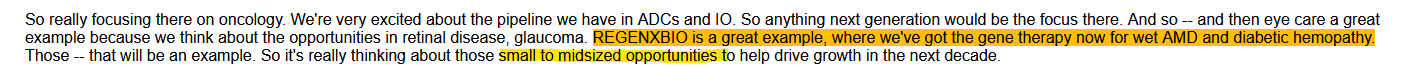

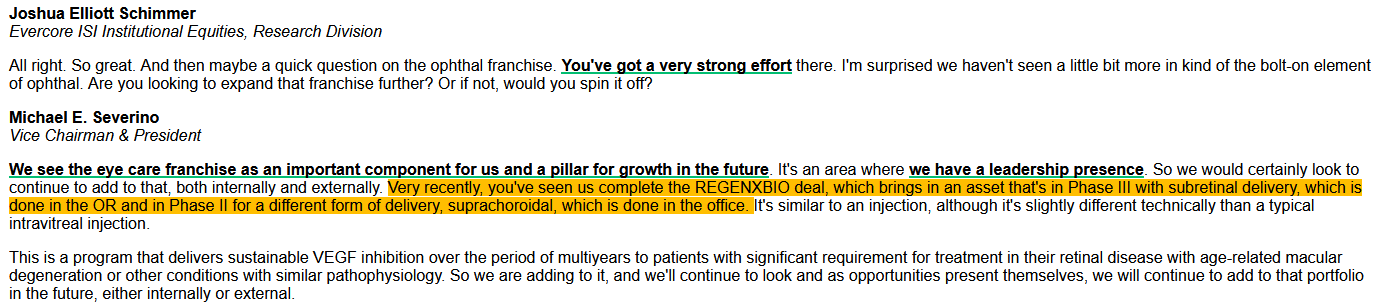

So why is this idiot on the internet telling you it´s a “crown jewel”? RGNX subsequently partnered up with ABBV in 2021 on the therapy (RGX-314). There was a lot of silence / neutral reporting on the partnership for quite a while, but starting over the course of 2023 until today, the tone shifted very clearly! I´ll be bombarding you with some snippets!

Am I the only one that thinks going from “small to midsized opportunity” to “highly transformative” and “significant opportunity” is a meaningful uplift? And we´re talking ABBV here, I´d assume they have quite a hurdle to “significant”. More:

Compare that to the neutral statement from 2021:

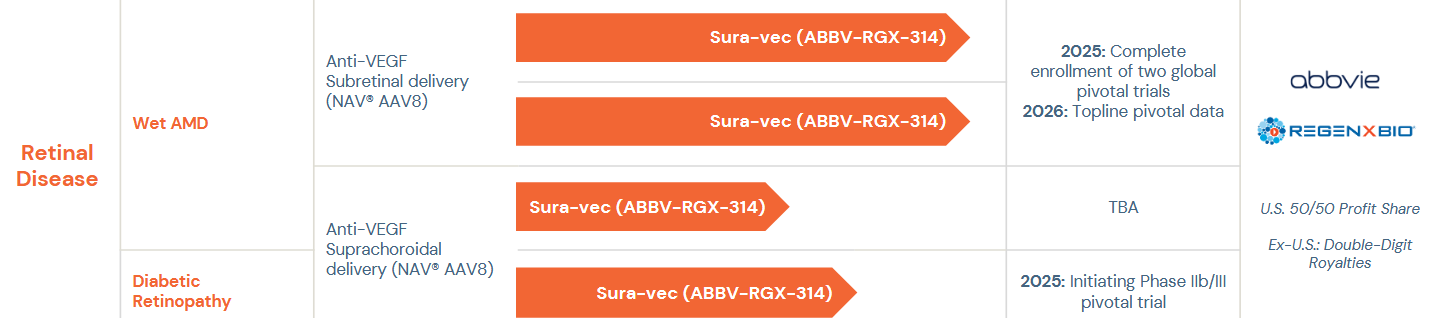

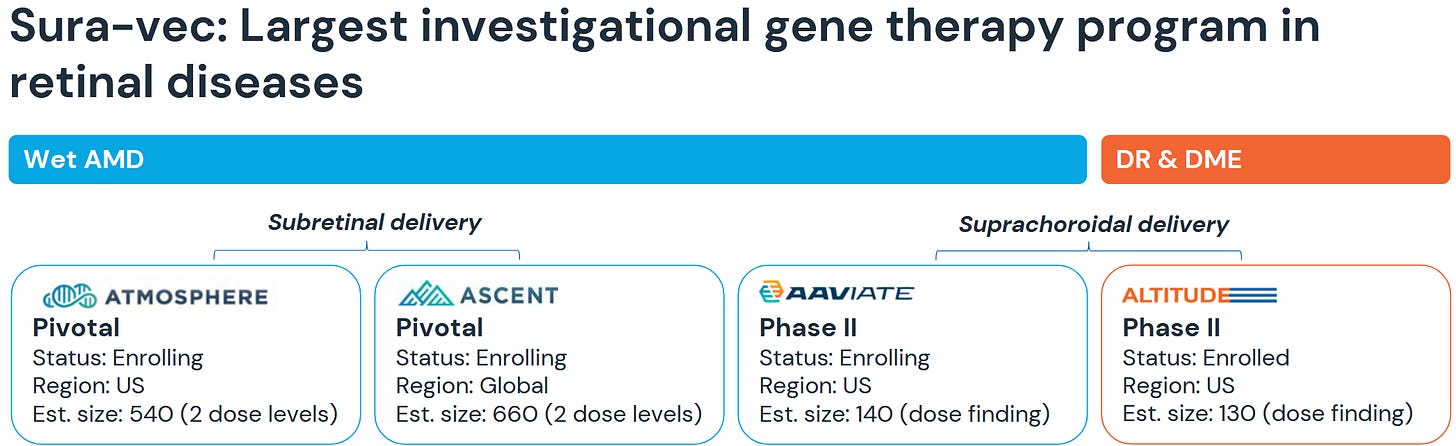

Now, before we get just too excited, there is ANOTHER caveat here! Does it ever stop? (Spoiler: No). Look at this pipeline-chart from RGNX:

As you can see, the wAMD trials are currently studied with subretinal delivery, so they are outside of the CLSD-agreement. The just recently initiated a Ph3-study in DR that uses the CLSD-delivery. What is subretinal?

“Urgh” you think? Yeah. Me too. It´s not quite clear from the pipeline-chart above, but RGNX/ABBV are actually also studying CLSD-delivery in wAMD and completely changed to that for the just recently initiated studies in DR&DME. Quite the endorsement, no?

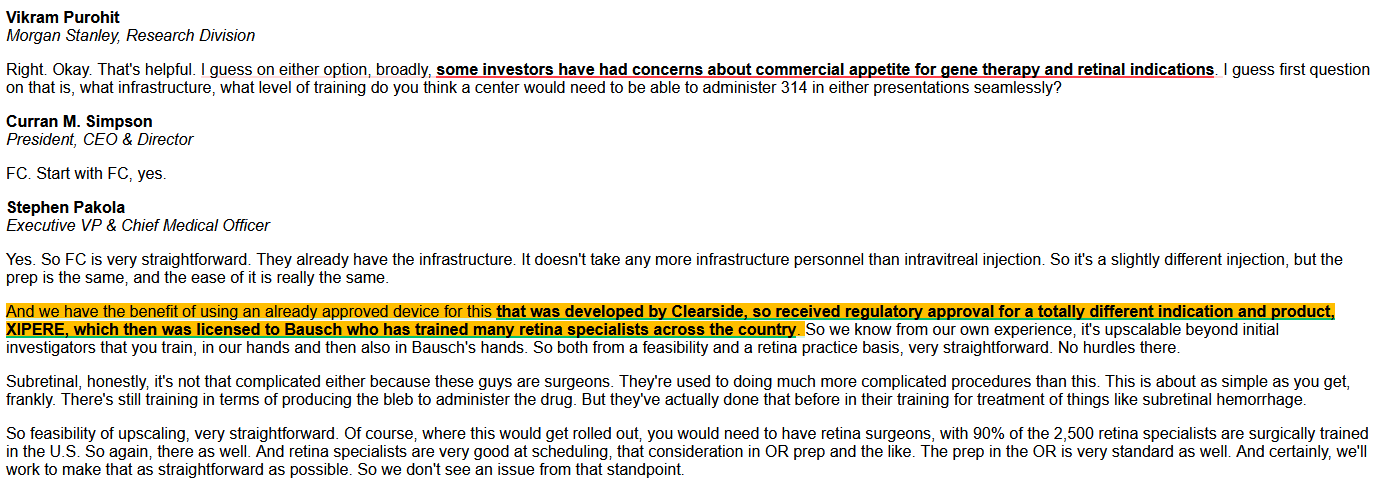

Let´s see - again - what the partners have to say about suprachoroidal delivery:

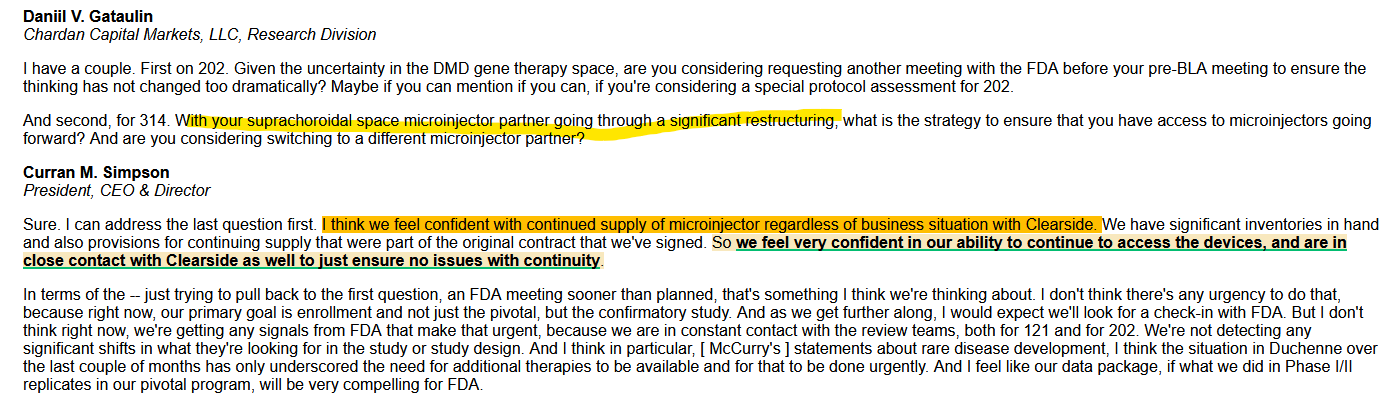

Oh and here is RGNX on CLSD going out of business :)

Clearside actually does not manufacture the Microinjector themselves, german Gerresheimer is doing that for them. So I don´t think that is something to worry about too much.

So… RGNX likes it, ABBV likes it - what´s in it for Clearside? Mid-single-digit-royalties + some “meager” milestones (31 development / 102 sales). OTOH, not so meager compared to the CLSD market cap or EV. A “casual” in-office gene therapy in combination with anti-inflammatory eye-drops for a couple of weeks to reduce / eliminate inflammation could generate a lot of revenue. Huge markets here in 3 indications and the excitement from ABBV would not exist if that were a 500 million US$ opportunity. They paid RGNX 200 million US$ just to initiate the studies in DR/DME!

Clearside receives royalties for the longer of A) 7 years or B) the expiry of the last valid patent, on a country-by-country-basis.

We can now model ourselves to death, but at the end of the day: IF this drug is successful, the payoff to Clearside will probably be 200-500 million US$ gross / undiscounted, depending on exact royalty rate, sales milestones, royalty term and - of course - commercial success of RGX-314.

If you want to reduce the stock to a single thesis, it is that RGX-314 will be successful and that value will partially accrue to shareholders at some point and everything on top is gravy. Is the PoS here 20%? 50%? 70%? I´d argue we´re looking at a rather high PoS for technical study success with remaining doubts about the commercial opportunity. Oh and this is of course subject to the HCR-debt. But one single year of 800-1.200 mln US$ (yes, I´m just making up big numbers now!) in sales with a 4-6% net royalty will probably wipe out all the debt (since that´ll triger lots of milestones as well).

The remaining partnerships

Now, that´s not it. Clearside has also partnered its technology (all subject to HCR-debt) to Aura Biosciences (AURA) and BioCryst Pharamceuticals (BCRX).

Aura is currently running a Phase-3-study in a rare ocular cancer. CLSD is eligible to receive 19.5 mln$ in additional non-sales milestones as well as “low to mid-single digit royalties”. Their market cap is 380 mln US$ so the market seems to be taking them at least somewhat seriously? No idea though. Would be a welcome addition to the payment stream.

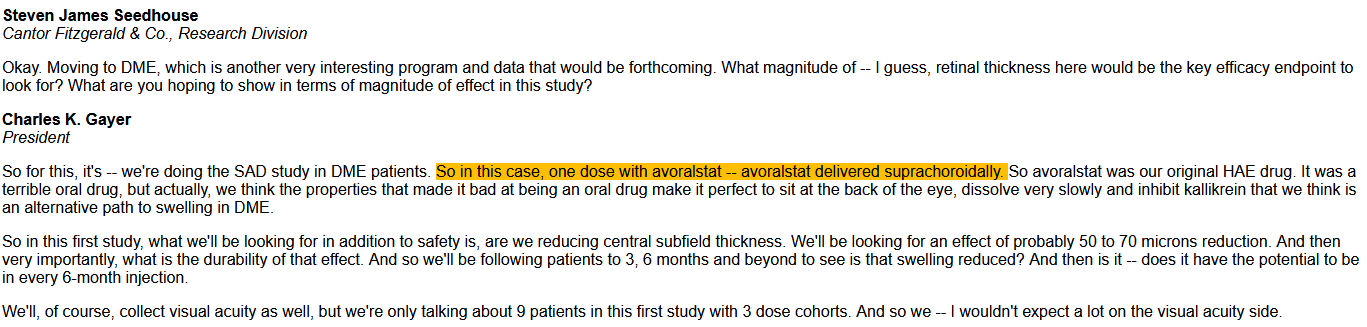

BCRX just recently initiated its first clinical study for the respective compound. Interestingly, it is a “failed drug”, so they know the attributes very well and think they can use them to their advantage if paired with suprachoroidal delivery. This is what they said on September 4, 2025:

The milestones on this are not too shabby. 30 mln US$ remaining in pre-commercial payments, 47.5 million US$ in sales milestones (with the highest hurdle at 2B US$ - so no). Tiered mid-single digit royalties. Most relevant value here is probably in the pre-commercial payments, simply given the nature of early development.

More to come?

Now, hear me out. I think we can safely assume, that Clearside maybe did not take every opportunity available to out-license this because they wanted to keep some optionality in development for themselves? Will interest in the technology increase, if and when more products come to market or show strong Phase-3-data?

There is little reason they could not strike additional deals. Maybe there are no indications left? Remember, author = idiot generalist!

More caveats and risks

Let´s get back to the core of this write-up: problems.

Patents around the Microinjector

I don´t really know when and if the (relevant) patents expire. Companies usually issue tons of patents, some of them make sense and hold up, some don´t. The royalty agreements I checked usually have a structure that asks for royalties for a certain minimum amount of time regardless of patents (most importantly RGNX/ABBV).

Then there are drug/device combinations like Xipere, where the approval is tied to the combination - but the underlying drug ist just a corticosteroid. Could Bausch just replace the CLSD Microinjector at some point? How much would that cost? What studies are needed?

So all the agreements I checked have a decent minimum term, but I would be lying if I said that I feel comfortable around this situation.

The shareholder base is… meh?

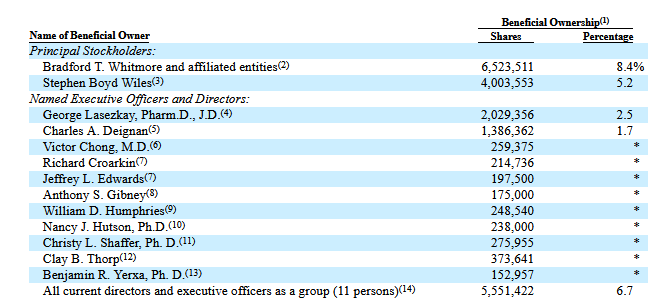

From the latest Proxy as of June 30 (Pre-RS-numbers):

Mr. Wiles is an ophthalmologist and involved in the stock since much higher. I will have the audacity to claim that he is probably not involved because he analyzed the risk-adjusted present value of the future cash flows of the partnerships to be higher than the market cap and the HCR royalty, but he just likes the technology (and likes /liked CLS-AX)? Happy to exchange thoughts and hear your view, if you happen to read my ramblings!

Cannot find much on Whitmore or his investment vehicle grace brothers, he is chairman somewhere else. Just did a quick Google search, don´t really care.

Insider incentives

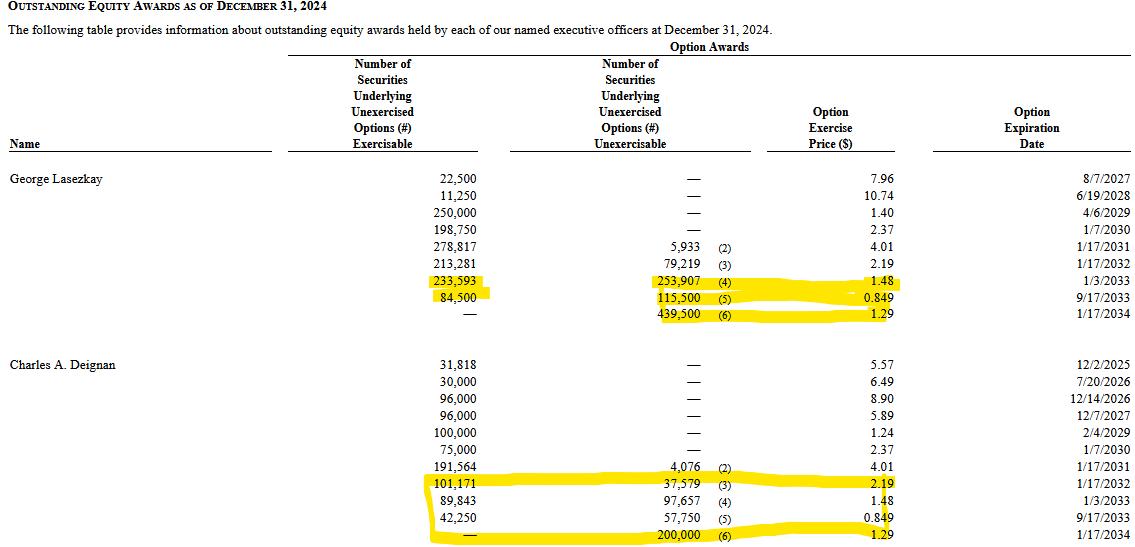

Lasezkay (ex-CEO, still advisor) and Deignan (ex-CFO, still advisor) have some decent exposure here. These are their pre-RS-options:

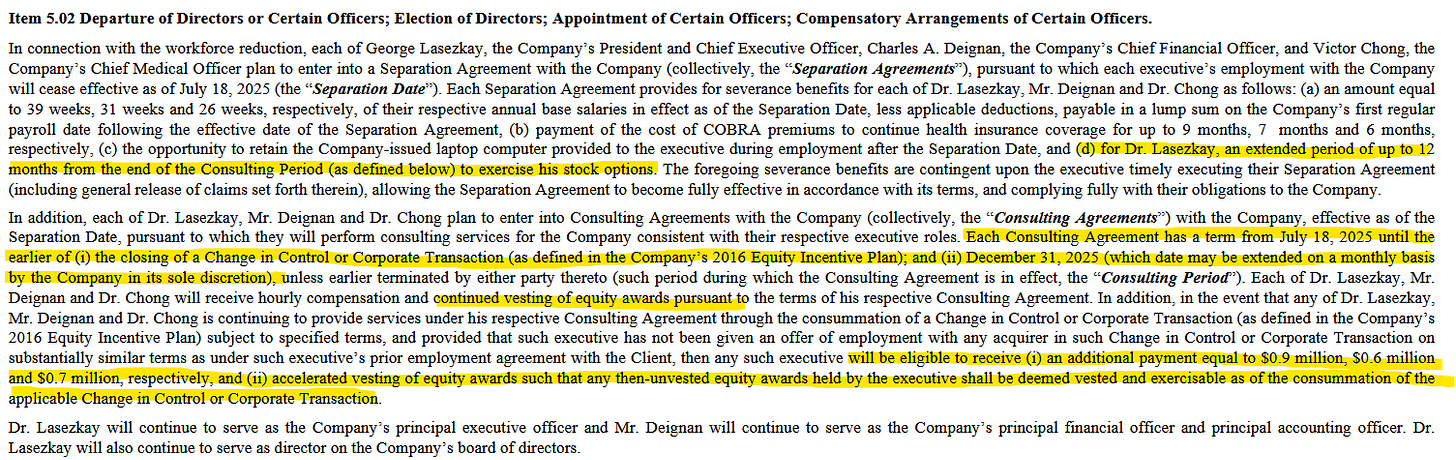

So these options run for a long time and their strikes are actually attainable, if one or more therapies are successful. Down - but not out. Let´s take a look at their agreements when the company let go of all employees:

The ex-C-suite gets some nice payments on a change of control (Factored these into my net debt at the beginning). So they are highly incentivized to sell the company. Sadly, they are only partially incentivized to sell it at a high price (through their remaining options).

I would´ve preferred it, if an external liquidator purely focussed on shareholder value would´ve come in to be honest.

They really put “the opportunity to retain the Company-issued laptop computer provided to the executive” in there. Great stuff.

What is it worth?

I don´t think it adds any material value to pump like 6 different royalty- and milestone streams with tons of assumptions and blind PoS-guessings into an excel and tell you what number is coming out at the end (I actually did it but it´s a lot of bullshit²).

What I did though is play around a bit and see, if there are reasonable scenarios where HCR is repaid in full and there are material payments to the company remaining. I think you can draw realistic pictures where the NPV accruing to shareholders eventually is twice to 10 times the current market cap. That should be clear just from this article. The overarching question is:

How do shareholders win?

There is probably a very decent shortfall to fund (just in G&A and some payments to the license-originator) since it´ll be a couple of years until the HCR-debt could be paid off.

Will Clearside sell off partial assets / amend the deal with HCR so they can go dark on the OTC and just exist for 200-300k / quarter until payments arrive? Will they sell themselves to a royalty aggregator like Xoma? If yes, how does payment look like? Will there be a CVR? Will we even see a take-under in this scenario where all of the value is put into the CVR? How much of the payments will then accrue to shareholders?

The best case would probably be if CLS-AX were to be sold and brought in a large amount, putting the company back into a decent net cash position and then we go from there.

From the partners, I feel like ABBV/RGNX and Bausch are the only ones in a position to pay off Clearside, but I fear shareholders of Clearside will not like the prices these “partners” will quote for that.

Bottom line: I feel like the collective NPV of all assets and partnerships is larger than the EV - driven mainly by the RGNX/ABBV partnership and Xipere. This bet is highly probabilistic in nature though, so this might very well be a scenario where buying the stock is the “right” thing to do - but you still lose. This can be a zero, no doubt!

I´m asking myself if I got involved just because the situation is so interesting and exotic - or if there is really a bargain to be made here? I lean to the latter, but I might just be married to the idea of being right here in such a clusterf*** of a situation. There are probably some readers in here thinking “Well that´s a nice short pitch right there, why did you buy the stock”?

Anyway - the weakness around the reverse split represents an interesting opportunity if something decent happens. This is not a large position for me, but not that small that it would not annoy me if it went the wrong way. What I would have loved to see are more positive aspects around governance (strong independend board, large influencial shareholders).

Maybe it´s better that way since it keeps the position small. There is probably also a case to be made to just own this tiny (or not at all?) and simply wait for one or more dominoes to fall into place.

Let´s see what happens. Tell me what you think! Do your own DD.

Disclaimer: I do have a beneficial long position in CLSD.

Great summary - impressed by your work!

I opened a position today and I am already fearful!