Hello World!

What this substack is about

I will expand on this post in time, just wanted to get it out here quick and dirty - what to expect and what not to expect.

1. I like writing about stocks and all things capital markets

It´s fun for me, it forces me to put a polishing touch on my own stock ideas, verify my takes more prudently and I like to just put my stuff out there to get feedback.

2. Why Biotech?

Even though I write almost exclusively about biotech, my background is basically 100% financial. In fact, I even hated biology and chemistry in school back in the days. Feel very free to correct any of my wrong healthcare statements - it is actually one of the reasons I put my stuff out there.

Other than that, the main reason for “Why Biotech” is, that there is a truckload of money to be made, especially as an active and quick market participant.

3. The companies I write about…

Are not good companies at all in most cases. This is putting it mildly for lots of cases. Biotech is rattled with companies that have tons of assets - but no intention at all to let shareholders participate in these assets. The market has realised this and it is one reason why a large amount of small biotech companies trade significantly below their net cash on hand.

Which makes it extremely attractive to systemically search for companies, where the assets might “suddenly” end up being actually owned by shareholders via liquidiations, buyout offers, special dividends or other corporate actions. This does happen somewhat at random, but over the years I realized that there is some method to the madness.

4. How much money is there to be made?

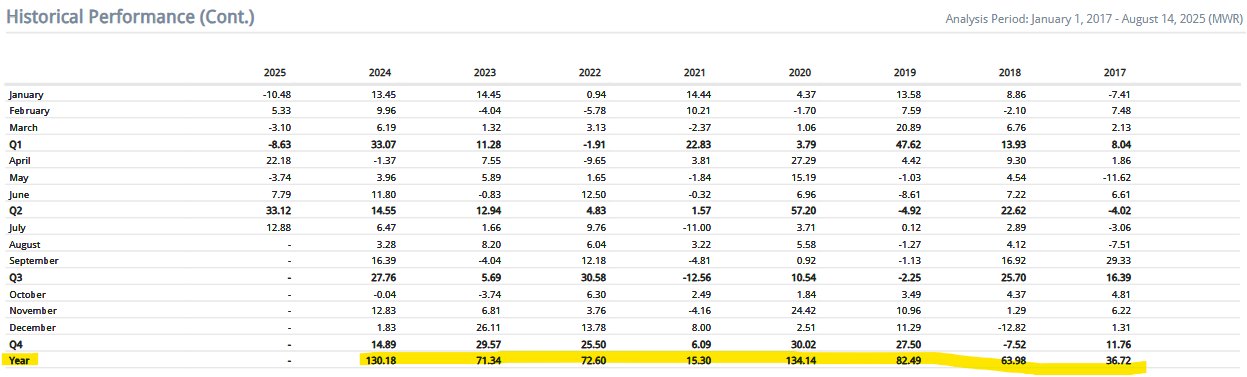

I am averaging a bit above 60% CAGR for over 7 years now. I will gladly put out my data from Interactive Brokers (best broker out there in my opinion especially for europeans, my referral link if you´re interested) in time, but right now there is a bug so apparently, I returned -8000% from Inception when I try to pull a report.

In this report, the PnL is not distorted. It doesn´t show a line but you can guess that this is a rather nice thing from the bottom left to the top right! In 2025 I changed my main trading account (for tax purposes) but am still “winding down” or managing number 1 presented here on the side. I´ll just show both.

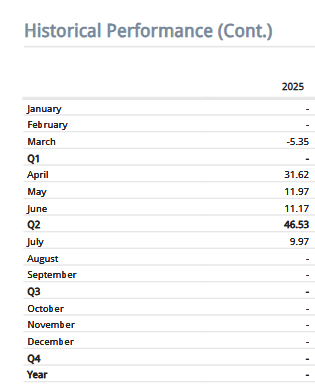

And this is the fresh account with my now main activity

The portfolio is unsurprisingly struggling a bit in times where biotech gets completely roasted, but almost always rebounds nicely - which in my opinion is due to the focus on somewhat hard assets and rotating aggressively when the market becomes stupid. Q2 2025 is a testament to that at a time where Biotech (XBI or BBC) was still very red ytd.

This is though happening while doing this full-time or almost full-time - you will not replicate this by looking at your account once a week (I guess). The stuff on this Substack and on X is usually just a fraction of my activity but probably mirrors the thought process behind 90% of my profits.

5. Other things to consider

I am from Germany, so I am not a native speaker and I live in a different timezone. When pre-market starts, I am well awake and ready to go since it´s midday for me. It´s actually a decent edge. On the other hand, after hours-trading goes way into the night - I tend to miss stuff there or just discover it by next morning.

As I said, I am investing / trading full-time. This also means, that I can change my opinion quickly. I will also always (if liquidity allows) trade my positions and shift my portfolio around - this is why I will not tell you how much weight to put into a stock or when to buy exactly what. One news - or the advent of a more attractive opportunity elsewhere - can change all that in a heartbeat.

I trade almost exclusively in the US, since it is by far the most regulated, liquid and dynamic market for small cap stocks in the world.

I also have no current plans to make this a paid service. I will actively post on twitter and use substack as a platform to get long form write-ups out there to fall back on.

Enjoy your posts. are you open to email exchanges?

Saw your post on ITOS & noticed I couldn't DM on twitter. Interested to swap notes if open. Thanks !