SEER: Revenue generating proteomics play at 50% of net cash

Upcoming governance catalyst in December to unlock value?

One thing I want to focus on here is highlighting obscure ideas or names that are basically not discussed at all on X. You don´t need me to help you lose money on VKTX ;-)

Quick overview

Seer (Ticker: SEER) is one of those obscure names which seem to check a lot of boxes but is basically never mentioned. Let´s start with the most important bullet points before we dive in:

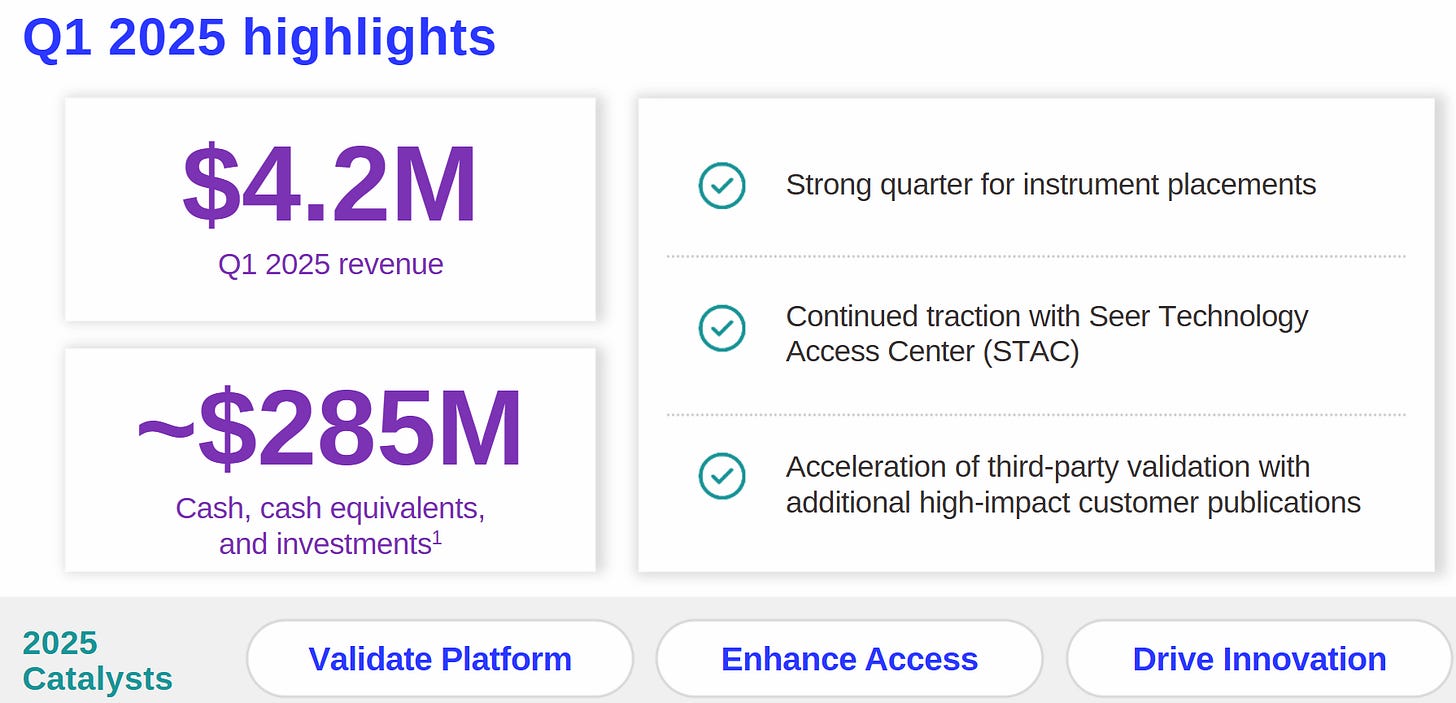

Seer trades at ~50% of net cash which is melting, but not too quickly

They generate sales of about 16-18 million US$ per year with about ~45% gross margin even on that very small scale

Company is buying back stock

The supervoting shares (“Class B”) of the CEO expire in December 2025 by converting into regular (“Class A”) shares

The Board of Directors is NOT staggered

Activist Kevin Tang is already involved

Thermo Fisher partnered up with them to co-promote their system

Current valuation

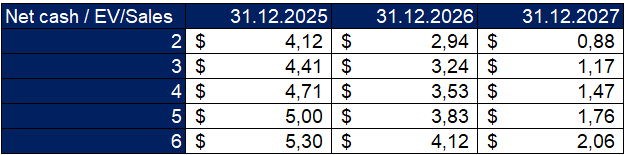

Most important part of this stock is its valuation. With 59.43 million shares out (Class A + Class B) and 262 million US$ of net cash as of March 31 2025, we are looking at 4.42 US$ of net cash per share. Probably around ~30 cents per share are being burned each quarter, which gives us roughly 3.53$ at the end of 2025 and 2.35$ (per share) at the end of 2027, so we don´t need the stock to win right away and have plenty of time.

There is one thing this stock has, which is rare in bioland: real revenues and real gross profits. It´s not exactly Danaher, but even if you ignore almost all the cash on the balance sheet, the stock is trading at ~7X Sales 2025e. The interesting thing is, that that gives you more runway / buffer than the typical R&D-heavy biotech companies, since there is more to its value than just cash about to be burned - net cash is not a ceiling on this stock!

Valuing the operating business at 3 times sales 2025e (17.5 million US$ at midpoint) gives us 52.5 million US$ on top of the balance sheet (Olink has been acquired for more than 15X Sales). Let´s take a look at how that looks like through time:

Read: If you vale them for their net cash as of year-end 2026 and a multiple of 3 on their sales, the stock is worth 3.24$ per share.

This is obviously still a melting ice cube, but my “model” has zero growth from 2025e in it (also no dilution, rising burn etc. so lots of factors at play).

Key takeaway for me: If the company is bought, hyped or turns around the business within 18 months, they will be worth ~3-4$ per share for an upside of 50-100% - while trading below its liquidation value of ~2.35$ per share as of end of 2026.

Business model

What do they do? Again, great opportunity to remind you that I know nothing about biology, chemistry, proteomics, proteins or whatever. Seer sells hard- and software to analyze the human proteome “unbiased”, which means they are not looking to validate that something exists or is absent, but try to deliver a result as wide as possible.

That should allow researchers interesting work: Are there ways to predict that a certain person gets a certain disease (or is at a higher risk)? Do healthy people have more of A and less of B - which can help to research new medicines.

Up until now it´s obviously a niche and if you are interested in details on the business, go ham. I will not ;-) Here is their investor presentation from January 2025.

Key takeaways for me: Revenue needs to ramp up, but showing a decent gross margin at that low level of sales is very encouraging. Thermo Fisher co-marketing Seer´s products even though they bought Olink is a strong signal in my eyes as well. That agreement launched in November 2024, so it still has to play out.

Why governance aspects are key here

I think this is the most important part of the analysis and the real reason I like the stock. As with Theravance: There is plenty of cheap stuff out there right now, but we need a reliable way to be (reasonable) certain that the value of a company actually accrues to shareholders. I am copying the bullet points from above down here:

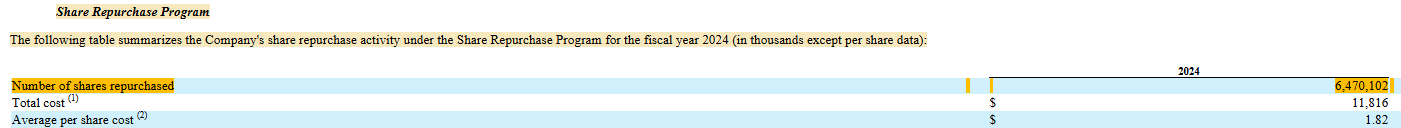

Company is buying back stock

The supervoting shares (“Class B”) of the CEO expire in December 2025 by converting into regular (“Class A”) shares

The Board of Directors is NOT staggered

Activist Kevin Tang is already involved

Share repurchase program

In May 2024 the company started a 25 million US$ buyback, which is a decent part of its market cap. I believe they are only buying below 2 US$ per share. I think this buyback is genuinely designed to maximize value per share - NOT drive up the stock price. Its effect has been very moderate - mostly due to the fact that dilution due to stock compensation offset the buyback. Still a strong signal that management likes to increase its relative ownership.

Dual share class

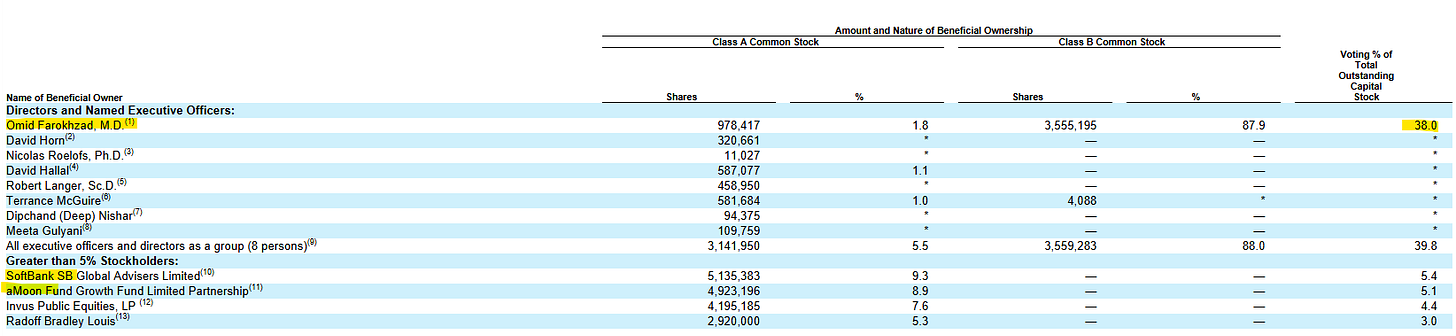

As I said, there are two classes of shares, which are effectively allocating a sufficient majority of voting power to the CEO. These are about to convert into regular shares:

“The Class B common stock will also automatically convert into shares of Class A common stock on December 9, 2025”

Omid Farokhzad will still be a very large shareholder after the conversion, but since the board is not staggered, investors could theoretically call for change beginning next year. To be honest I am surprised that Softbank is still involved. So far, there is not really any implication of an activist, but Kevin Tang has been involved in varying quantity (guess he is trading the ups and downs).

Nonetheless - beginning soon, shareholders could get fed up with management. The stock price performance is nothing short of horrible and even though management is at least acting reasonable (cutting costs, buying back stock, not entrenching itself), I personally think this company has a way better home in the private markets.

They company does not need access to capital and is simply bearing the unnecessary costs of being public.

How do we win though?

What is missing so far is a key way to “win”: Maybe management will take the company private again? Maybe Thermo Fisher is interested in an acquisition slightly above net cash? Maybe there is 1 or 2 holders waiting for December to go activist? If you have aMoon, Tang and potentially some other holders pressing for some sort of change / strategic alternatives, there can quickly be 20%+ of the register demanding board representation or similar things.

Another way for this to be a successful investment is - shockingly - that their product works and sells well. They are guiding for significant growth in 2025 (+24%) and if that continues into 2026, today´s valuation looks very cheap very quickly and the iceberg´s speed of melting would be reduced significantly as well.

But the simplest way to win is via “strategic alternatives”. If this happens within the next 18 months, the return on the stock is probably going to be around at least +50-100% (depending on timing / multiple / revenue).

What to do?

Seer is a stock where you have to be extremely focused on price. I am trading it on and off for over a year now. I want to be involved as the conversion of Class B shares comes closer and keep monitoring the situation (revenue, burn, changes in shareholders). At the current price of 2.14$ this is rather a “starter” for me, but I bought more way cheaper and would gladly to that again if the stock drops.

If one of the large holders want out, they could quickly push this down 20-30% which would be an excellent entry for a larger position in my opinion (I have it at 2% right now if you care, but that can change quickly with news / price).

Disclaimer: Nothing on this blog is investing or financial advice, do your own DD. I do have a beneficial long position in SEER as of writing.

P.S. random facts

As I think this is “simply” a strong risk/reward but not a pretty much risk-free play (as Theravance was at 8.40 US$) I wanted to keep the write-up short and just introduce the stock for now. There is some stuff I did not mention but is somewhat relevant - if you are intrigued by the stock, read on.

Bob Langer sits on the BoD.

18% of revenue is from academics and 12% from governments - recent NIH funding cuts are a risk here (though incorporated into guidance as management is well aware).

Some more comments from the recent conference call, some of these surprisingly strong (yellow emphasis by me):

I (or ChatGPT) estimates a 10.000 sample-study to translate into roughly 3-5 million US$ of revenue btw.

Thermo partnership just beginning to ramp up.

Stock price vs value and more cost cuts coming (just take the damn thing private).

If you want to really dig in, you can use this Deep Research by ChatGPT as a starting point, though in my opinion it´s just a lot of words for saying “this is so cheap that the r/r is strong”.

Great read! Just came across this from a governance perspective - https://x.com/CountryRoadR/status/1965540588364988733