HLVX: A "lease CVR" - something else for a change!

The most unnecessary deep lease analysis you will read this week! Or ever.

Unfortunately, I like weird stuff to invest in. This is weird! So here we go, the quicky-analysis first:

HLVX is a broken biotech being taken over for roughly net cash.

The CVR is trading around 10-12 Cents.

In my opinion it is worth 15 cents at bare minimum (WOW such return) but provides a nice call option on top with a somewhat credible buyer that is NOT Kevin Tang.

Clinical vaccine assets are totally out of favor currently with an anti-vaxxer at the helm of HHS. That made it impossible to fund planned developments, but could actually fetch a price down the road when MAGAs rule on HHS might end.

HLVX offers a nice return in my opinion if bought with discipline at the right price and you get a very decent call-option on top which might or might not pay.

Background to HilleVax

HLVX is one of special sits with lots of questionmarks. I initially bought a ton of shares on the data-dip (when their lead asset failed) below 1.50$ in 2024 and traded the stock on and off since. At that time, they had 4$ or a touch more in net cash. So I want to start with shaming management into wasting HALF(!) of the companies assets or a staggering 100 million US$ on absolutely nothing. They have zero to show for and needed 1 year to “kind-of-liquidate”. If you ever needed a reason to not invest in biotech, this is it.

100 million US$! I see that sh*t everyday but still am amazed anew every week I do this. The sums waisted in this sector are an atrocity.

What probably happened is, that the company initally planned to purse its other vaccine-assets further and then RFK Jr. happened and the company staid in denial for 6 more months before finally accepting reality. Even in May 2025, they still stated that:

The company is exploring the potential for continued development of its norovirus vaccine candidates in adults as well as business development related activities and other strategic alternatives.

Yeah. No.

The transaction with XOMA

As is almost customary right now, HLVX decided to sell itself to XOMA for about net cash with a CVR. The structure of the CVR is as follows (from merger 8-K edited for clarity):

(1) 90% of any net proceeds received by Parent within five years following regulatory approval from any disposition of any and all remaining norovirus vaccine programs of the Company if such disposition or a financing of such program occurs within two years following the closing of the Merger.

(2) between 90% and 100% of certain savings realized by Parent following the closing of the Merger on the obligations under the “Harrison lease” regarding the premises on the fifth floor of the building known as 321 Harrison Avenue, Boston, including the net proceeds received from any sublease of the premises (which will also include the Sublease (as defined below)).

(3) the excess or shortfall, if any, of the final net cash as calculated 90 days following the closing of the Merger pursuant to the CVR Agreement over or under $102.95 million.

I will build my case on mainly (2) and hope for the best on (1) and (3) as I will - if I am correct - not pay for (1) anyway. Let´s have a look if we find some money lying around:

Looking at closing net cash

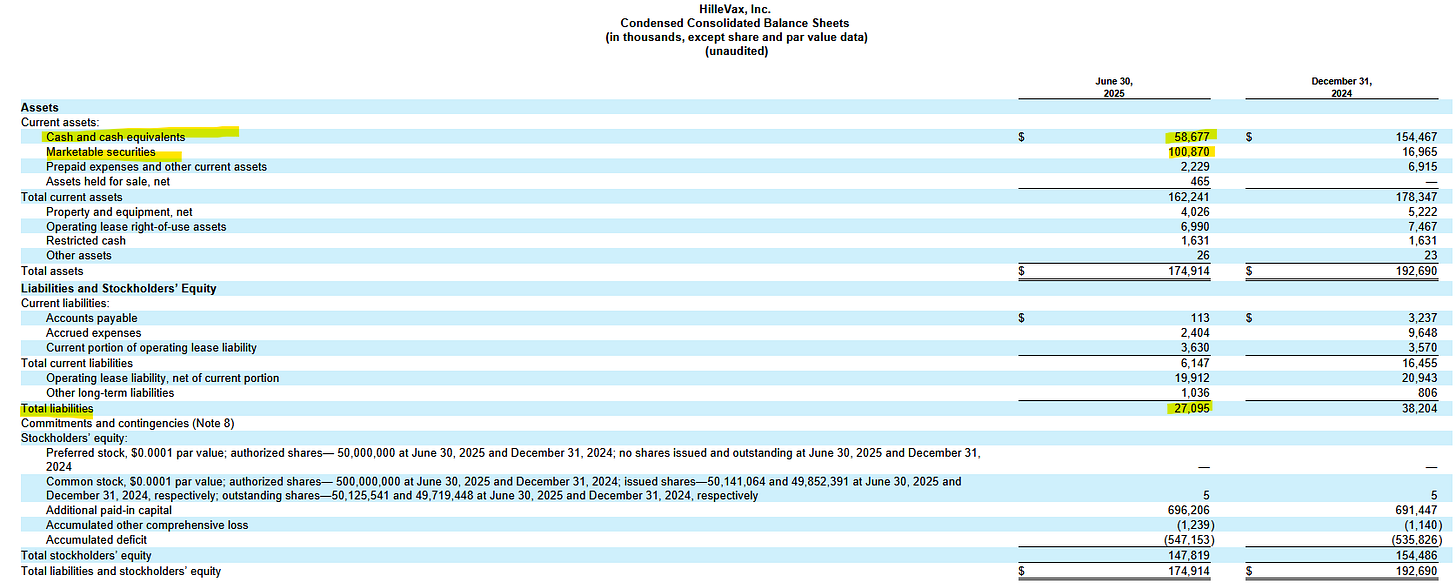

If you look at the closing net cash hurdle for the CVR of 102.95 million US$ and compare that to the balance sheet, you will intially be somewhat confused:

At first glance, the company appears to own more than 130 million US$ in net cash as of end of June and the quarterly burn of ~ 6ish million US$ until closing does not explain the vast difference. Are we looking at a huge payment from (3)?

Lets take one step back. XOMA offers 1.95$ per share which works out to 97.77 million US$ on the last sharecount. Factor in some minimal dilution, it is probably going to bei 97.95 million US$ which in turn means, XOMA gets paid 5 million US$ for the liquidation (102.95-97.95). IF(!) both parties agreed to that sum, it would probably make the most sense to structure the net cash sweep in the money which would provide the easiest handling. I think?!

Let´s head back to net cash. With a touch more than 6 million US$ in Q3 burn and an estimated 5 million US$ of costs for closing down (total of 11 for D&O insurance, severances, banker pay, ongoing cost) we arrive at a 11.22 million US$ net cash excess if we assume lease liabilities at their undiscounted sum of 30.6 million US$. Still plenty of room and looks very enticing, no?

This is where experience joins the game. Something strange happened at Kronos (a similar situation I covered here). When they terminated lease liabilites of ~30 million US$ for 20.5 million US$, they generated savings of - you sure as hell did not guess it - 18.2 million US$. My first reaction amounted to roughly THAT:

But it all makes sense. While the company capitalizes its direct lease obligation on the balance sheet, these usually do not contain e.g. “common area maintenance, property taxes, insurance, utilities, janitorial services and other administrative fees” which means liabilities are higher than they seem. Since none of these plays actually publish the net cash schedule on which all these mergers are based upon (wtf but different story), we can only take educated guesses.

So I did the only sensible thing: I checked, how many years were left on the Kronos lease, how many sqft that property had and how high the savings were in excess over the undiscounted lease per sqft per year. I landed at around 38.67ish US$ (math it out yourself or trust me). Extrapolating this number to the HLVX-Lease gives me 9.15 mln US$ in additional costs over the term of the lease (until end of 2032) and the net cash sweep melts down to 2.07 million US$ or 4 cents a share.

Have I mentioned the absurd amount of money yet that biotechs burn on nothing?

I think there is some room for a higher closing net cash since the transaction should close a bit sooner than end of Q3 (mid of September probably) and burn for Q3 should be smaller than Q2, but there is also potential for more unpleasant surprises so I think it is safe to call the net cash sweep a zeroish. They also show 2.2 million US$ in “prepaid expenses” and 0.465 million US$ in “Assets held for sale” which will be added to closing net cash (security deposit for lease will not be added).

So while I think there is potential for a 0.5 to 5 million US$ payment (1 to 10 cents a share) it is very hard to estimate. Let´s put that thought to the side and look at the “savings” part of the CVR.

Show me the money: payments from savings

If the closing net cash disappoints, there is a positive element. If actual costs after closing are lower than estimated, these $ return to shareholders. I expect these figures to consist mostly of lease payments and excess costs described above, which makes for a total pool of roughly 39.5 million US$ or 0.79$ per share (plus other smaller costs but the majority will be won or lost here).

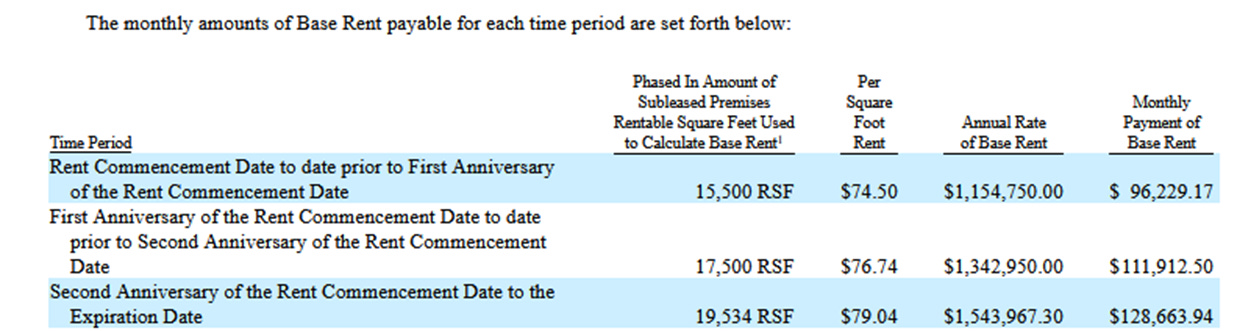

Now we also have some information about a sublease, which happened at the end of July (see merger 8k linked above). Hillevax subleased a large part of its floor to Stelaaromics, a company already leasing the floor above. This is how it looks like:

This is a substantial discount to the amount HLVX pays (120-130 $ per sq ft I guess). But still, it´s something. That sublease runs for 3 years and 2 months. The floor plan attached shoes that the total zone for freshly cashed up Stellaromics (just completed a 80 million US$ funding round) will expa

nd to ~75ish percent of the space. They committed to paying 61.6% of excess costs, so we have have quite some payments in addition to the lease.

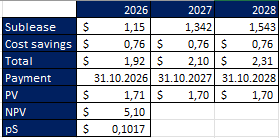

At this point we can do some quick calculations for the savings-CVR:

Discount rate is 10%, I ignored the 2 months included and the date for payment is as lazily chosen as is formatting ;-)

So, if my assumptions (especially regarding the “bridge” from Kronos to Hillevax lease) are correct, the stock is worth ~2.05 US$ (ignoring some tiny discounting for the 5-6 weeks until closing) per share. And that is with 4 years of lease left un-leased for the Stellaromics part AND probably around 6,511 sqft remaining in total.

If these are subleased as well at 75$ per sqft flat and ~30% of excess costs are allocated, the sublease income would amount to 859,564 US$ a year. If that were to happen, the NPV10 would equate to 4.49 million US$ or 8.94 US-cents per CVR.

There might be a decent probability that Stellaromics will expand to that space in 3 years. I think it is rather unreasonable to expect this value to be generated in total, but it is also unlikely that zero value will be generated.

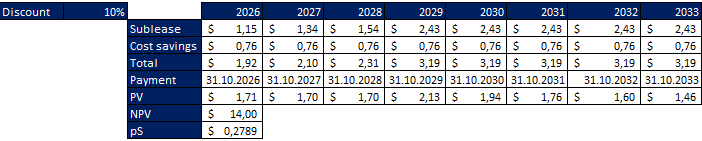

Let´s do something fun. Let´s assume Stellaromics will continue to lease throughout the whole term until end of 2032 AND sublease the additional space from 2029 (which will sit empty until then). The price per sqft will stay at 79.04$. Total NPV of that scenario would equate to 14 million US$ or 27.89 Cents per CVR. Which is not unrealistic at all I would guess?

At this point we would also expect that the complete lease will turn over to Stellaromics, XOMA will pay a one-off-payment to the landlord and the whole thing will be terminated and cashed-out in 2029 which will probably add additional NPV.

Oh and the company put down 1.6 million US$ as a security deposit which might or might not be returned at some point. If they are paid out in 2033 (without interest, which would be included) it would represent an NPV10 of 1.45 US-cents per CVR. Maybe yes, maybe no - nice optionality to have.

Payments from assets

With RFK Jr. in the game, vaccines will undoubtedly have a hard time. But we can receive payments for up to 5 years and I think it is not completely unreasonable to assume, that in a world without RFK, some milestone payments might hit the CVR.

The remaining asset (HL-214 was returned to Takeda) was in-licensed in 2024 for 15 million US$ upfront.

The unmet need is there and I think it is not completely unimaginable that somebody will buy it and put it on the shelf to initiate further studies on an administrative change or RFK leave/death/worm-incident. In that scenario the main issue will be that the real value-creating milestones might happen outside of the 5-year-timeframe, but since we are probably paying zero for that part (or depending on how much you trust my lease-analysis we get paid to own that call-option) anyway, I don´t really care.

Each 5 million US$ gives ~8.9 US-cents (since we receive 90% of that). You tell me if it is unreasonable to think that somebody pays 5 million US$ for the asset and a further 5 million US$ on initiating a clinical study.

There might be other IP or assets I overlooked, sometimes biotechs own more than they publicly show. Would not expect that to be the case here as there is no real “discovery-engine” behind the company.

Putting it together

I think FOR NOW(!) most of the value resides in cost-savings from the sublease of the Harrison-Lease. With the payments already to be received by Stellaromics, at a 2.07$ ask the stock prices only minimal further sublease-success which I think is rather unlikely.

I think the boring part here is that you are probably not going to make many multiples of your money. Even though it is entirely possible, it is extremely unlikely that the remaining asset puts out any huge payments in short order.

Still, I would put the CVR at 20-30 US-cents just as of today, mentally allocating 80-90% of value to the optionality around further lease-agreements, with or without Stellaromics.

Unless I am completely unaware of some risks, this looks like risking maybe 2 cents (if at all) to make 15-20. It will most likely not be the investment you will still tell your grandchildren about, but this looks like possibly a nice, clean win.

The CVR payments will be reduced by some costs (pretty customary) which might be a drag of maybe 2-4 US-cents (implying 1-2 million US$ in costs over the lifetime). Given the economics around the Harrison-Lease, I think this is very acceptable. These cost-clauses usually become a problem, if the payments receivable in total are very small.

All in all, I like the CVR here (2.07 US$ for the stock) and love it if HLVX would drop a touch closer to 2 US$. The tender offer will be initiated soon, I expect closing around September 12.

Disclaimer: Nothing on this blog is investing or financial advice, do your own DD. I do have a beneficial long position in HLVX as of writing.

Additional thoughts

If excess closing net cash is negative, these amounts have to be recovered first. But I think it does not really matter, as closing net cash will only be negative if cost assumptions for the future are very high. That in return would increase the pool for future cost-savings-payments, if and when these cost assumptions turn out too high.

XOMA paid out high end of net cash for Kinnate in a similar transaction (closing net cash might actually pay some here) and also transacted all of their assets in an attractive deal with at least high headline numbers. Unlike Kevin Tang, they seem to be not sleeping at the beach during the monetization period of assets.

They also stated in the past in interviews (Biotech TV interview - shoutout to Brad, awesome stuff) and conference calls that they are mainly interested in these deals if the assets are promising, so I might be completely underestimating the true value drive, which might surprisingly be the norovirus-asset? Very open to surprises ;-)

CVR payments from sublease income decline to 90% if the agreement is entered into 12 months after closing. I think I introduced enough conservatism (no increase in sqft e.g.) in my calculations to just ignore the step-down. But otherwise it doesn´t take any rocket science to just distract 10% of all payments in excess of the existing Stellaromics lease so just do that if you want to feel safer.

The payments from sublease savings are paid out when they reach 500k US$ so the CVR should pay out regularly.

My calculations assume 50.2 million CVRs.

Happy to hear additional elements I overlooked.

If there’s no asset sale during 2 years after closing the CVR expires, right? My assumption was that if Stella subsequently renews their lease after three years CVR holders don’t get any of those savings as the CVR is dead by then. What’s your take on that?

Something else I would note is that the balance sheet lease liability has a discount rate and the undiscounted liability is higher